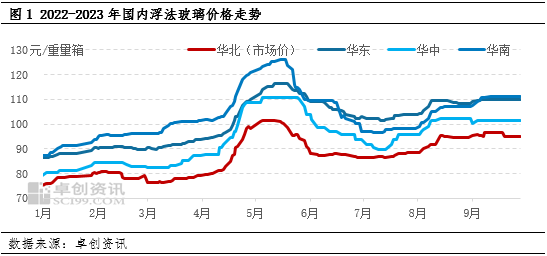

Production costs around the world have soared in recent months, and they have fallen only marginally in 2020, driven by rising energy, raw material, and ocean freight prices, as well as difficulties in obtaining certain raw materials or the prices of expensive raw materials.

The glass industry, which has a very high energy demand, has been hit hard. According to Simone Baratta, director of business fragrances and beauty at Italian glassmaker Bormioli Luigi, compared to the beginning of 2021, the increase in production costs has been considerable, mainly due to soaring gas and energy costs. He worries that this growth will continue in 2022. This is something not seen since the October 1974 oil crisis!

And all the components necessary for production: raw materials, pallets, cardboard, transportation, etc. are growing. ”

A sharp rise in production

For the premium glass industry, this cost increase comes against the backdrop of a sharp increase in production. Thomas Riou, CEO of Verescence, said, “We are seeing an increase in all kinds of economic activity and will return to pre-COVID-19 levels, however, we believe caution should be exercised in a market that has been in a downturn for two years, but This stage has not stabilized.”

In response to the increase in demand, Pochet Group has restarted furnaces that had been shut down during the pandemic, hiring and training some people, said éric Lafargue, sales director of the Pochet du Courval Group, “We are not yet sure that this high level of demand will be sustained in the long term. down.”

So the question is to know which part of these costs will be absorbed by the profit margins of the different players in the industry, and whether part of it will be passed on to the sales price. Glass makers interviewed by PremiumBeautyNews unanimously said that the increase in production has not been enough to compensate for rising production costs and that the industry is currently in jeopardy. Therefore, most of them confirmed that they have started negotiations with customers to adjust the selling price of their products.

Profit margins are being swallowed

étienne Gruye stressed, “Today, our profits have been severely eroded. Glass manufacturers lost a lot of money during the crisis, and we think we will be able to recover due to the recovery in volumes during the recovery. We do see a recovery, but not profitability. ability”.

Thomas Riou said, “After the penalty of fixed costs in 2020, the situation is very critical.” This analysis is the same situation in Germany or Italy.

Rudolf Wurm, sales director at German glassmaker HeinzGlas, said the industry had now entered “a complex situation where our profit margins have been severely reduced”.

Simone Baratta of BormioliLuigi said, “The model of growing volumes enough to make up for rising costs is no longer effective. If we want to maintain the same quality of service and product, we need to create profit margins with the help of the market.”

This sudden and unexpected change in production conditions has led industrialists to largely initiate cost-cutting programs, while also alerting their clients to the industry’s sustainability risks.

Thomas Riou of Verescence.com stated, “Our first priority is to protect the small businesses that depend on us, which are integral to the ecosystem.”

Pass-through Cost Protection Industrial Fabrics

If all industry players make their business operations more efficient, considering the particularity of the glass industry, this crisis can only be overcome through negotiation. Revising prices, evaluating storage policies, or considering cyclical delays, all together, each vendor has its own priorities, but they have all been negotiated.

éric Lafargue said, “We have strengthened our communication with customers to optimize our production capacity and control our inventories. We are also negotiating agreements with customers to transfer all or part of the funds from the sharp rise in energy and raw material costs, etc.”

A mutually agreed outcome appears to be crucial to the future of the industry.

Pochet’s éric Lafargue insists, “We need the support of our customers to sustain the industry. This crisis has shown the place of strategic suppliers in the value chain. It’s a whole ecosystem, and if anyone part is missing, the product is lost. incomplete.”

Simone Baratta, managing director of BormioliLuigi, said, “This particular situation requires a special response that slows manufacturers’ innovation and investment.”

Manufacturers insist that the necessary mark-up is only around 10 cents at best, factored into the price of the final product, but the increase is likely to be absorbed by the profit margins of brands, some of which have posted record highs in a row. profit. Some glassmakers see this as a positive situation that shows the industry is healthy but must benefit all players.

Source: China Glass Network

If you have any ideas, please feel free to contact us anytime.

+86 0755 86152161 inquiry@hongjiaglass.com