Soda ash increased significantly in the third quarter, and glass profits narrowed

In the third quarter, the price of float glass rose primarily, enabling the industry to maintain a profitable state. However, the significant increase in the price of raw material soda ash has led to a slight narrowing of profits for glass enterprises. Although the soda ash prices are expected to be weak in the fourth quarter, the pressure of rising fuel costs, coupled with the weakening glass prices, may further reduce the profitability of the glass industry.

The increase in glass prices lags behind that of soda ash, resulting in a narrowing of profits for glass enterprises.

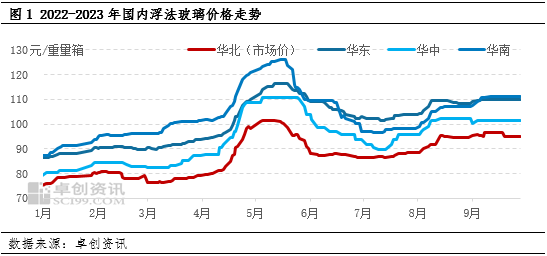

In the third quarter, the domestic float glass market saw a rise primarily, driven by seasonal peak demand and the improvement of downstream essential needs, leading to price increases. By the end of September, the average national price of float glass was 2115.50 yuan/ton, an increase of 178.93 yuan/ton compared to the end of June, representing a growth of 9.24%. The glass market entered the traditional peak season in the third quarter, with an improvement in downstream processing plant orders compared to the second quarter. In phases, the orders of processing plants were generally inadequate in July, but some markets gradually initiated pre-season conventional stocking towards the end of the month, leading to a slight price increase. From August, the situation improved for downstream processing plant orders, with most operating at full capacity. The enthusiasm for essential restocking and stocking further increased. In September, the workload of most processing plants remained high, but some plants had limited orders for the fourth quarter, leading to cautious stocking. Although there was a certain increase in glass production in the supply side during the third quarter, the overall supply and demand structure remained acceptable, providing some support to the prices.

Soda ash is the main raw material for glass, and its price increased significantly in the third quarter, directly leading to an increase in the production cost of glass. With the concentrated maintenance of soda ash units in the third quarter, the overall operating load of soda ash manufacturers decreased, and the inventories of upstream and downstream decreased to a low level compared to the same period in recent years, resulting in an expanded market supply gap. Some difficulties existed for downstream replenishment, leading to a significant increase in market prices. Although the maintenance entered the final stage in September, supply gradually recovered, and market prices fell slightly, they still remained at a high level for nearly a decade. By the end of September, the mainstream ex-factory price of domestic light alkali was 3015 yuan/ton, an increase of 52% compared to the end of June; the mainstream terminal price of heavy alkali was 3180-3400 yuan/ton, an increase of 56.7% compared to the end of June.

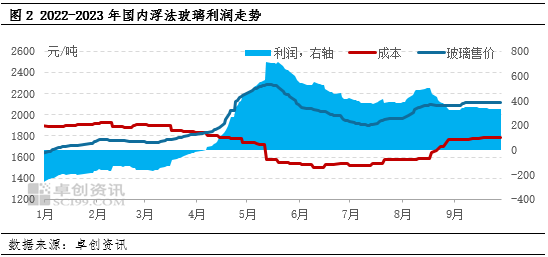

In terms of costs, the tight prices of raw material soda ash led to an increase in the cost of float glass, but a certain level of profitability was still maintained. Rough calculations show that by the end of September, the comprehensive profit of domestic float glass was 335.39 yuan/ton, a decrease of 84.52 yuan/ton compared to the end of June. The cost of soda ash for producing one unit of glass increased by nearly 200 yuan/ton. The cumulative increase in raw material and fuel costs exceeded the increase in glass prices, leading to a slight overall decline in profits. However, the industry still remains profitable.

The fourth quarter is expected to witness a weakening trend in raw material costs, but it may not change the downward trend of glass profitability.

Looking at the trend of the key raw material soda ash prices for glass, it is expected that the capacity release of soda ash in the fourth quarter will be concentrated, with the supply growth rate expected to be faster than the demand growth rate. The market supply pattern is expected to change from tight to loose, exerting significant downward pressure on soda ash market prices. On the supply side, in October, the reduction of maintenance units is not significant, and the industry’s operating load has rebounded to a high level of more than 90%. The overall inventory of soda ash manufacturers has increased, and additionally, the imports of alkali goods have gradually arrived at ports from September to October, leading to a gradual increase in domestic soda ash supply pressure.

Looking at the glass market, the overall expectation for the fourth quarter is relatively weak. With the end of the seasonal peak season, rush work has become the main driving force on the demand side, while the capacity of the supply side remains high, and there is an expectation for further increase. The center of gravity of glass prices is expected to shift downward. There is an expectation for a decline in raw material costs, but there may be an increase in heating season fuel prices, leading to a further narrowing of glass profit expectations.